Around lunchtime in Harare’s city centre, a small supermarket once watched customers abandon full baskets because they had no cash. Today the same store accepts cards, EcoCash, United States dollars and Zimbabwe dollars at one counter using ZB Bank POS machines. Queues move quicker, cash handling is lower and the owner can track every transaction from a single ZB Bank account.

This is the promise of ZB Bank POS machines for businesses in Zimbabwe. One device brings together card payments, mobile money and multi-currency support, while ZB provides settlement, reporting and support in the background. In this article you will see what the machines can do, how they benefit customers and merchants, and how to get one for your own shop, pharmacy, school, church or event.

ZB Bank POS Machines: What They Offer

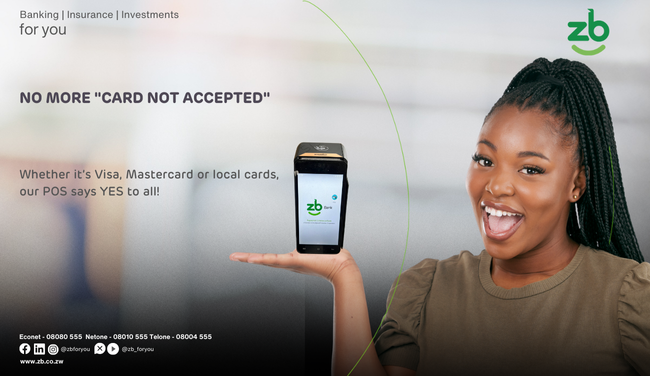

ZB has designed ZB Bank POS machines to handle the payment methods that matter most in Zimbabwe.

Accepts all major cards

Zimswitch for local card holders.

International schemes such as VISA and Mastercard for visitors and diaspora.

Dual currency capability

Process both United States dollars and Zimbabwe dollars on the same device.

Let the customer choose the currency that suits them at the till.

Mobile money ready

Accept EcoCash so customers can pay from their phones instead of using cash.

Tap and go contactless payments

Customers simply tap, pay and move on.

Very useful in high traffic environments such as supermarkets and bus termini.

Integration ready for tills and registers

Connect into existing point of sale systems for better accuracy and reconciliations.

WiFi enabled and portable

Works in stores, markets and outdoor venues where WiFi or mobile data is available.

Available for hire for events

Ideal for weddings, lobola functions, church gatherings, parties, product launches, fundraisers and corporate events.

“ZB Bank POS machines stand out because they accept all major payment methods including Zimswitch, VISA, Mastercard, United States dollars, Zimbabwe dollars and mobile money like EcoCash. Businesses no longer need separate devices for each payment rail.”

ZB Bank POS Machines: Benefits for Your Business

ZB Bank POS Machines and Customer Experience

Customers want to shop without worrying about how they will pay. With ZB Bank POS machines they can:

Pay using a card, EcoCash or preferred currency instead of carrying large amounts of cash.

Enjoy fast tap, swipe or insert transactions.

Benefit from encrypted processing that protects card and wallet details.

This convenience builds trust in your brand and encourages repeat visits.

ZB Bank POS Machines and Merchant Security

Cash on the premises raises the risk of robbery, loss and internal fraud. Moving to ZB Bank POS machines helps to:

Reduce the amount of physical cash in tills and safes.

Send funds directly to your ZB Bank account, which lowers the temptation for theft.

Provide clear digital records for audits and investigations.

“Merchants enjoy faster checkouts, better customer satisfaction and lower cash handling risks. Funds settle directly into the ZB account and merchants receive detailed transaction reports, backed by twenty four hour technical support.”

ZB Bank POS Machines and Cash Flow

Healthy cash flow keeps stock on shelves and salaries paid on time. ZB supports this by ensuring:

Quick authorisation of transactions.

Settlement straight into the merchant’s ZB account.

Clear end of day summaries that simplify reconciliation.

This structure removes most of the delays and leakages that come with counting and banking cash.

ZB Bank POS Machines: Where You Will Find Them

You will already see ZB Bank POS machines in many everyday locations across Zimbabwe:

Major retail outlets and supermarkets.

Small and medium shops in towns and growth points.

Pharmacies and medical practices.

Schools and tertiary institutions for fees and levies.

Local authorities and municipal offices for rates and service charges.

This wide footprint gives customers confidence that their card or mobile wallet will be accepted wherever they go.

ZB Bank POS Machines: How to Get One

Applying for ZB Bank POS machines is straightforward, whether you are a large retailer or a start-up merchant.

Basic requirement

An active ZB Bank account in your business or personal name, depending on your structure.

Application channels

Visit any ZB service centre across Zimbabwe and request POS merchant onboarding.

Engage the International IVSC team for guided onboarding if you operate multiple branches or process high volumes.

Submit a request through the ZB Bank website if you prefer a digital route.

What happens next

ZB collects your business details, expected transaction volumes and preferred settlement account.

You sign the merchant agreement.

ZB configures your POS machine and arranges delivery or collection.

The team provides training for your staff and ensures the device is tested on site.

You receive access to transaction reports and twenty four hour support lines.

For strategic deployments or integration into large retail systems, merchants can work directly with Rudo Manjengwa, Executive Head Retail and Digital Banking, on the number supplied in the POS information pack.

ZB Bank POS Machines: Frequently Asked Questions

Here are answers to some of the most common questions about ZB Bank POS machines.

What makes ZB Bank POS machines different from other devices?+−

ZB Bank POS machines accept Zimswitch, VISA, Mastercard, EcoCash and both United States dollars and Zimbabwe dollars on one device. They also offer WiFi connectivity, tap and go payments and integration into tills, so you do not need separate terminals for each payment type.

How do ZB Bank POS machines help merchants every day?+−

Merchants enjoy faster checkouts, better customer experience and higher sales because customers are not limited by cash in their pockets. Cash on site is reduced and funds settle directly into the merchant’s ZB account. Detailed transaction reports support easy reconciliation and record keeping.

Can ZB Bank POS machines be used at events or in remote locations?+−

Yes. The devices are portable and WiFi enabled, which makes them suitable for weddings, lobola sessions, church gatherings, fundraisers, parties and product launches. Many organisers hire a POS machine from ZB for a specific weekend or function.

What support does ZB provide after I receive the device?+−

ZB offers training during installation, telephone support at any time, and help with device maintenance and software updates. If your POS stops working, the support team will assist you to restore service or arrange a replacement unit so that trading can continue with minimal disruption.

ZB Bank POS Machines: How to Use Them for Events

Event organisers often need a professional way to collect payments at once-off functions without dealing with large amounts of cash. ZB Bank POS machines are well suited to this need.

Planning and booking

Contact ZB well before the event date to book the number of POS machines you need.

Confirm that the venue has WiFi or mobile network coverage so that transactions will process smoothly.

Decide where each machine will be stationed, for example at the bar, food area, ticket desk or offering point.

On the day

Assign responsible people to operate the devices and make sure they attend the short training from ZB.

Display clear signs to inform guests that they can pay using cards or EcoCash.

Encourage electronic payments first so that you hold less cash.

After the event

Use ZB transaction summaries and settlement reports to count how much was collected at each payment point.

Match the amounts to your budgets or fundraising targets.

Use the same reports for accounting and audit purposes.

“Our portable ZB Bank POS machines give event organisers a secure and professional way to receive money while guests simply tap or swipe. This is popular for weddings, church events and corporate launches across Zimbabwe.”

Conclusion

Zimbabwean customers are moving quickly toward cards, mobile wallets and digital channels. Businesses that keep up with this shift protect themselves from cash risk and open the door to new sales. ZB Bank POS machines give you the tools to do this with one compact device that accepts almost every major payment method in the country.

To bring this solution into your own organization :